how much does the uk raise in taxes

Alternatively the government could achieve the. The Institute for Fiscal Studies said the latest tax increases amounted to 14bn.

Richard Burgon Mp On Twitter Richard Investing Twitter

With the potential to raise 70bn a year 8 of total tax revenues taken by the government the financial benefits do add up while the criticisms of wealth taxes simply dont.

. The three big sources of revenue for the UK central government in 2023 will be income tax at 3067 billion national insurance at 1581 billion and indirect taxes at 3082 billion for a total of 8995 billion. This upper limit is 79 higher than it was in 20182019 46351. By 2025 26 billion people will have access to.

However inequality in the UK has increased since 1980. This represented a net. If you make more than 50000 in 20202021 you qualify for the higher rate threshold which means that you need to pay 40 tax on any income you earn over this amount.

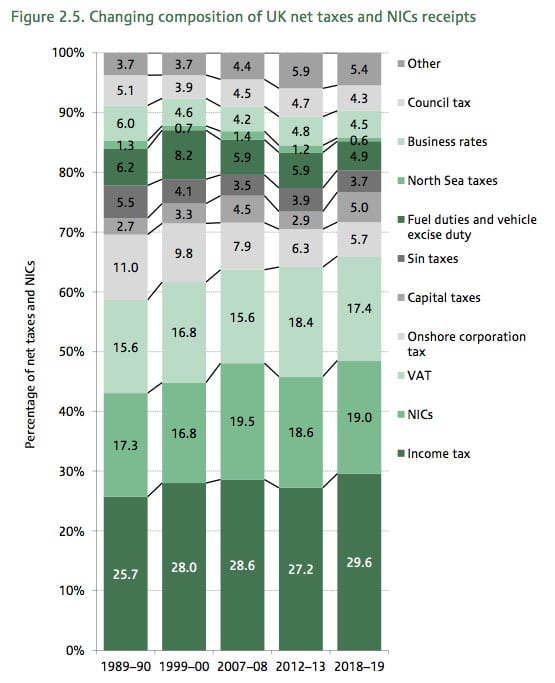

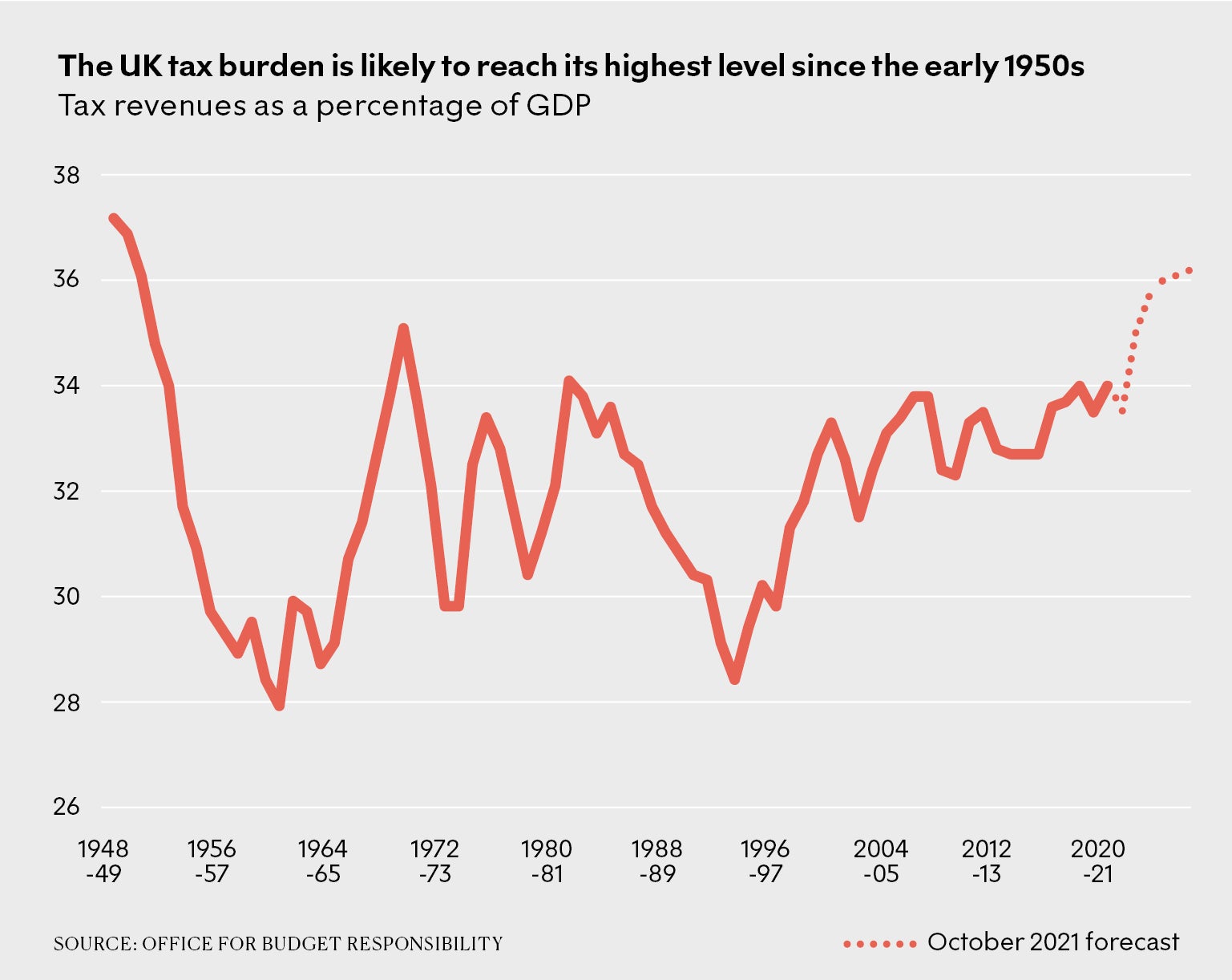

From 168 billion in 202122 to 6 billion in 202223. The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. Figure 1 shows that tax as a share of national income has fluctuated between around 30 and 35 of national income since the end of the second world war and been rising since the early 1990s.

In line with inflation there will be an increase in allowances and the basic rate limit. A basic tax rate of 20 applies to everyone who earns between 12501 and 50000. It would need to impose a permanent annual increase in taxes or cut in spending equal to 43 per cent of GDP 84bn in todays money in 2022-23.

We estimate local authorities will collect about 40 billion in council tax in FY 2023 and 134 billion in other revenue for a total of 597 billion. From 6 April 2022 Class 1 and Class 4 national insurance contributions are set to increase by 125 percentage points for anyone earning above the primary threshold of 9880. That would be an extra 91000 in tax revenue per person.

According to the 20182019 Government Expenditure and Revenue in Scotland GERS report tax revenue in north of the border amounted to. Income threshold for high taxation rate on income was decreased to 32011 in 2013. The main rate of corporation tax will increase from 19 to 25 as of April 2023 and companies that earn less than GBP 50000 per year will see their small profits rate increase from 19 to 19.

Then at 543 am. But receive over 5000 in tax credits and benefits. Tuesday salv8dor_ messaged her Im about to.

Receipts have recovered their pre-recession share of national income and on current policy are set to rise slightly as a share of national income between now and 201920 and then remain relatively flat until the end of the forecast horizon Figure 1. Overall the average household pays 12000 in tax and receives 5000 in benefits. Much of the revenue initially.

Together with those announced in the March Budget it. Increase 45 additional rate of Income Tax by 1p. Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m.

The poorest 10 pay 4000 in tax mostly indirect VAT excise duty. Increasing Income Tax for only the highest rate taxpayers would raise an estimated additional 60 million next year if introduced in April 100 million the year after and 90 million the year after that. This is effectively a tax rise.

UK tax revenues were equivalent to 33 of GDP in 2019. How much does the UK raise in tax compared to other countries. The increased taxes will raise almost 36 billion 496 billion over the next three years according to the government with money from the levy going directly to Britains health-.

They receive around 2000 in benefits. The table below shows the national insurance rates for the 202223 tax year. Just wanted to tag you he said back.

From 229 in total income taxes it is anticipated that receipts will increase. How much money does Scotland contribute to the UK in taxes. One of the most famous examples of a windfall tax in the UK was one announced by then-chancellor Gordon Brown in 1997 when the privatised utilities were hit for around 5bn to pay for New Labour.

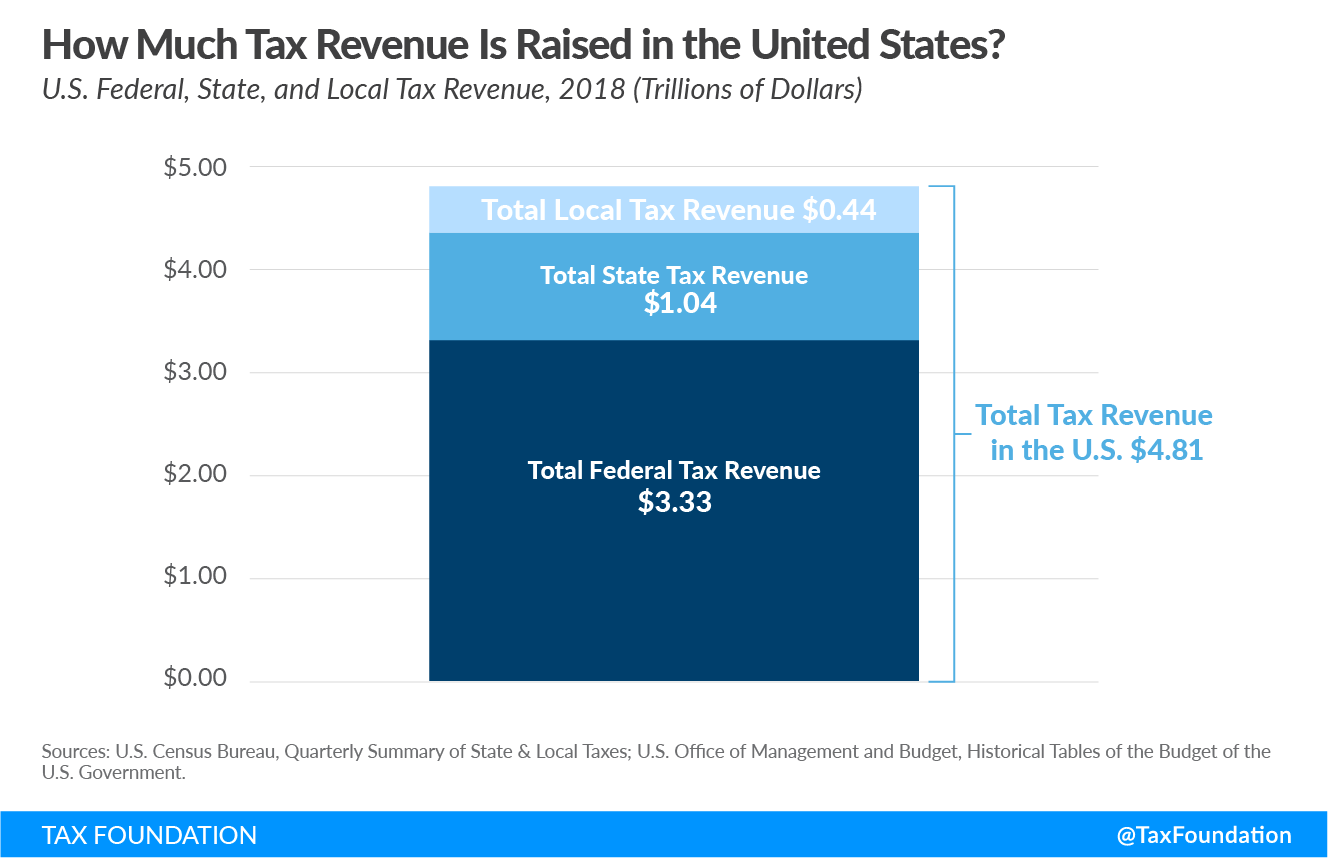

In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds. This is slightly below the average for both the OECD 34 and G7 36 and considerably lower than many other European countries average tax revenue among the EU14 was 39 of GDP in 2019. A 40bn tax rise would be the equivalent of an increase of 7p on the basic rate of income tax or an increase of six per cent on VAT he said.

The UK raised 35 of national income in tax in 201819. Total tax receipts in 201718 are forecast to be 690 billion. The richest 10 pay over 30000 in tax mostly direct income tax.

From April 2010 the Labour government introduced a 50 income tax rate for those earning more than 150000. This table reflects the removal of the 10 starting rate from April 2008 which also saw the 22 income tax rate drop to 20. 23 hours agowhat your guns gotta do with me she replied on Friday.

Government Revenue Taxes Are The Price We Pay For Government

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Pin On Making Money Online The Right Way For Anyone

Government Revenue Taxes Are The Price We Pay For Government

Do Not Miss This Last Opportunity To File Your Income Tax Return Before The Final Deadline Of Dec 31 19 Reaches Only 5 D Online Taxes Income Tax Filing Taxes

How Do Taxes Affect Income Inequality Tax Policy Center

Gst Suvidha Kendra Kendra Gst Filing Taxes Money Transfer How To Apply

Government Revenue Taxes Are The Price We Pay For Government

Uk Government Revenue Sources 2022 Statista

The Rise Of High Tax Britain New Statesman

Types Of Tax In Uk Economics Help

And While You Re At It Give Them A Proper Lesson In Taxation Taxes Humor Accounting Humor Funny Quotes

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget